What Is The Best THCA Flowers For Relaxation And Sleep

Discovering The Best Thca Flowers For Relaxation And Sleep

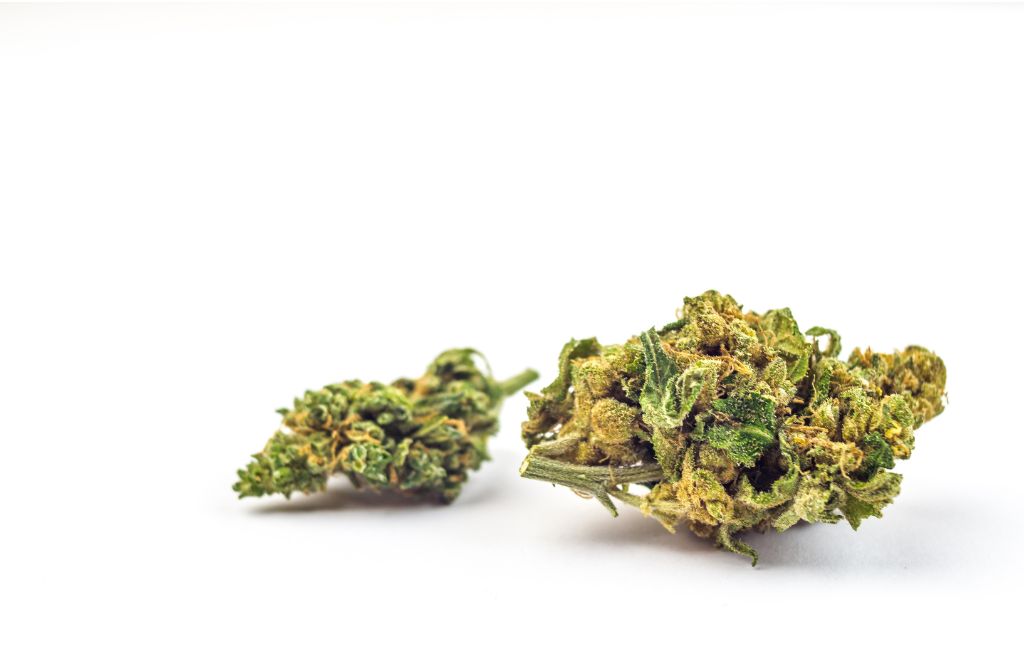

Best THCA Flowers In recent years, there has been actually a rise in advantage neighboring the possible restorative perks of cannabinoids, particularly Tetrahydrocannabinolic Acid (THCA). As the non-intoxicating prototype to THC, THCA is obtaining interest for its possible to use leisure and aid in sleeping. With an assortment of marijuana tensions offered, selecting the best THCA blossom for relaxation and sleeping may be discouraging. In this short article, we’ll examine the features of several of the greatest THCA flower petals for promoting relaxation as well as boosting sleeping high quality.

Knowing THCA

THCA is a naturally taking place compound discovered in uncooked cannabis vegetations. Unlike THC, THCA is non-intoxicating and have to be actually decarboxylated (hot) to convert into THC, the psychedelic compound responsible for the “higher” associated with cannabis usage. Nevertheless, research study suggests that THCA has its own curative properties, featuring anti-inflammatory, neuroprotective, as well as anti-emetic results.

Picking The Best THCA Flowers

When picking THCA blossoms for leisure and sleeping, it’s essential to take into consideration different factors, consisting of terpene profile, cannabinoid content, and specific level of sensitivity to different strains. Right here are some pressures renowned for their comforting effects:

Grandfather Purple

Grandfather Purple, an indica-dominant strain, is actually treasured for its strong leisure buildings. With extreme levels of THCA and also myrcene, a terpene known for its own tranquillizing results, Granddaddy Purple is actually frequently suggested for evening usage to unwind and ensure peaceful sleep.

North Lights

North Lights is actually a classic indica tension celebrated for its own capacity to induce strong leisure as well as reduce sleeping disorders. Rich in THCA as well as featuring an unique down-to-earth and sweet smell, Northern Lights is chosen through a lot of for its own comforting results on both the mind and body.

ACDC

For those seeking relaxation without the envigorating impacts normally associated with THC-rich tensions, ACDC offers an appealing answer. This high-CBD, low-THCA stress is renowned for its anxiolytic residential or commercial properties, making it an outstanding choice for individuals sensitive to THC or even those seeking remedy for anxiety as well as worry.

Bubba Kush

Bubba Kush is actually an indica pressure respected for its own strong sedative effects and also capability to induce a feeling of rich relaxation. With extreme degrees of THCA and also an one-of-a-kind blend of terpenes, featuring caryophyllene as well as limonene, Bubba Kush is a preferred selection for those finding relief from sleep problems as well as muscle mass pressure.

Purple Punch

Violet Punch is actually an indica-leaning crossbreed understood for its own delightful, fruity smell and also highly effective enjoyable effects. Along with a THCA-rich profile as well as a combination of terpenes such as myrcene and caryophyllene, Purple Punch is usually highly recommended for evening make use of to loosen up and advertise sleeping.

Introducing The Therapeutic Potential Of Thca Flowers For Relaxation And Sleep Enhancement

In the realm of all-natural solutions, cannabinoids have actually become promising candidates for promoting leisure and boosting sleeping high quality. Tetrahydrocannabinolic Acid (THCA), a forerunner to THC, has achieved focus for its own non-intoxicating residential or commercial properties as well as possible curative advantages. As enthusiasm in marijuana continues to develop, checking out the greatest THCA flower petals for relaxation and sleep ends up being increasingly pertinent. This short article strives to dig deeper in to the curative possibility of THCA blossoms and highlight some popular pressures renowned for their relaxing effects.

The Therapeutic Potential Of THCA

THCA, bountiful in raw cannabis vegetations, provides a myriad of possible healing results. While study on THCA is still in its infancy, preliminary studies recommend that it may possess anti-inflammatory, neuroprotective, and also anti-emetic buildings. Furthermore, anecdotal evidence suggests that THCA may add to relaxation and also rest enlargement without the psychedelic impacts related to THC. By using the healing possibility of THCA, individuals can easily discover all-natural options to conventional sleeping help and also leisure approaches.

Discovering THCA-Rich Strains

When looking for THCA blooms for leisure and also rest enhancement, it’s essential to take into consideration elements like cannabinoid web content, terpene profile, and individual choices. Listed below are some notable THCA-rich stress recognized for their soothing effects:

Blue Dream

Blue Dream is a sativa-dominant hybrid celebrated for its own balanced effects as well as uplifting high qualities. While mostly recognized for its high THC web content, Blue Dream also has substantial levels of THCA, making it a functional possibility for relaxation as well as tension comfort. Along with a wonderful, berry-like smell as well as delicate smart impacts, Blue Dream agrees with for daytime use or relaxing at night without generating sleep or sedation.

Cherry Wine

Cherry Wine is a CBD-dominant pressure appreciated for its calming homes as well as very little psychoactive results. With reduced degrees of THC and superior concentrations of THCA as well as CBD, Cherry Wine delivers a gentle strategy to leisure and also sleep enhancement. Ideal for individuals seeking remedy for stress or pain without intoxication, Cherry Wine markets a sense of tranquility as well as calmness.

Buffoon

Buffoon is a sativa-dominant crossbreed renowned for its own well balanced cannabinoid account and uplifting impacts. Featuring very high levels of THCA as well as CBD, Harlequin gives a distinct combo of relaxation as well as psychological clarity. With a spicy, earthy smell as well as understated bliss, Harlequin is favored by lots of for alleviating anxiety and also advertising relaxed rest without harming cognitive feature.

Treatment

Treatment is actually an indica-dominant pressure prized for its potent curative homes and also tranquillizing impacts. Along with high levels of THCA and CBD, Remedy offers a mild however, efficient remedy for relaxation and also rest augmentation. Known for its natural, woody fragrance and soothing effect, Remedy is excellent for evening usage or taking a break after a long time.

Final Thought

Incorporating THCA-rich cannabis florals in to your well-being schedule may supply an all-natural service for leisure and also improving rest top quality. Having said that, it is actually important to bear in mind that private knowledge may vary, as well as talking to a healthcare professional is recommended, specifically for those along with underlying wellness disorders or problems. By looking into tensions like Granddaddy Purple, Northern Lights, ACDC, Bubba Kush, as well as Purple Punch, individuals may find out the best THCA blooms satisfied to their unique requirements and choices, breaking the ice for an even more relaxing and invigorating evening’s sleep.

Assessing the Beneficial Effects of THCa Flowers

In the arena of cannabis, THC (tetrahydrocannabinol) preponderates as the most prominent as well as sought-after cannabinoid. Nevertheless, there is actually a lesser-known cannabinoid that is actually been obtaining interest for its own potential curative benefits: THCa (tetrahydrocannabinolic acid). While THC is actually worshiped for its psychedelic results, THCa, its own prototype, provides a various assortment of residential properties that may stun numerous. Within this write-up, our team’ll examine the world of THCa flowers and also explore the prospective benefits they provide past the typical THC experience.

Recognizing THCa Flowers

THCa is the prototype to THC as well as is discovered in uncooked, unheated cannabis vegetations. When marijuana is gathered and also dried out, it contains THCa rather than THC. It’s just when warmth is administered– with methods like smoking cigarettes, vaping, or food preparation– that THCa is exchanged THC with a process called decarboxylation. This sale discharges the psychedelic residential properties THC is actually popular for.

THCa flowers, therefore, refer to cannabis flowers that have certainly not undertaken decarboxylation and also still consist of THCa in its own uncooked form. These flowers may be eaten in various methods, delivering a various cannabinoid account and also prospective perks reviewed to their decarboxylated versions.

The Potential Benefits of THCa Flowers

- Non-Psychoactive Properties: One of the essential distinctions in between THCa and THC is that THCa does certainly not create psychedelic results on its own. This brings in THCa flowers an eye-catching possibility for those looking for the possible restorative benefits of marijuana without experiencing intoxication. People that are sensitive to THC or even desire to prevent its own psychoactive impacts might locate THCa flowers to become an appropriate substitute.

- Anti-Inflammatory Effects: Research suggests that THCa possesses anti-inflammatory buildings, which may make it useful for taking care of ailments defined by inflammation, like joint inflammation, Crohn’s disease, and a number of sclerosis. Through minimizing swelling, THCa may aid relieve pain and also boost total health.

- Neuroprotective Properties: Preliminary studies signify that THCa might possess neuroprotective results, implying it can assist safeguard nerve cells from damages or degeneration. This possible creates THCa flowers an interesting area of research study for health conditions like Alzheimer’s condition, Parkinson’s ailment, as well as neuropathic pain.

- Anti-Nausea and Antiemetic Effects: Some unscientific evidence advises that THCa might help lessen nausea as well as throwing up, making it likely helpful for individuals undergoing radiation treatment or experiencing motion sickness. While further research study is actually needed to have to entirely comprehend these effects, initial findings are actually promising.

- Appetite Stimulation: Like THC, THCa might additionally stimulate hunger, frequently pertained to as the “munchies” impact. For individuals having problem with cravings reduction as a result of clinical health conditions or therapies like chemotherapy, THCa flowers could use an all-natural way to improve cravings as well as market nutrition.

- Antioxidant Properties: THCa exhibits antioxidant residential properties, which play a critical part in defending cells coming from oxidative stress as well as damage caused by cost-free radicals. Through scavenging free of charge radicals, THCa might help reduce the threat of persistent health conditions and support overall wellness and longevity.

Exactly How to Use THCa Flowers

There are a number of techniques to take in THCa flowers to experience their potential advantages:

- Raw Consumption: Consuming raw cannabis flowers by including them to mixed greens, shakes, or even juices is actually a prominent procedure to protect THCa. Nonetheless, it is actually important to note that biting marijuana might have a verdant or natural preference, which might not be tasty to every person.

- Cold Weather Extraction: Cold extraction techniques, including helping make cannabis-infused oils or even tinctures without administering heat, can aid preserve THCa’s biting type. These removes can be utilized topically or consumed orally for targeted alleviation.

- Sublingual Administration: Sublingual administration entails placing marijuana removes or tinctures under the tongue, allowing for rapid absorption right into the bloodstream. This technique bypasses the gastrointestinal system, delivering easy onset and also likely boosted bioavailability of THCa.

- Evaporation: Vaporizing THCa flowers at reduced temps preserves their raw cannabinoid account while preventing the ignition related to smoking cigarettes. Vaporizers heat energy marijuana listed below the point of combustion, discharging vapor that could be breathed in for a smoother and potentially even more savory adventure.

Checking Out THCa Flowers: A Promising Frontier in Cannabis

In recent years, the cannabis field has actually observed a rise in enthusiasm bordering cannabinoids past the famous THC and CBD. One of these lesser-known substances, THCa (tetrahydrocannabinolic acid) has emerged as a subject matter of manipulation for its own prospective curative homes. Unlike THC, which is actually recognized for its own psychedelic effects, THCa supplies a non-intoxicating option that may supply a series of wellness advantages. In this particular short article, our team’ll dive deeper in to the planet of THCa flowers and also discover their prospective apps as well as conveniences.

The Science Behind THCa

THCa is actually the acidic prototype to THC located in raw cannabis vegetations. It’s abundant in recently harvested cannabis prior to it goes through decarboxylation, a procedure that turns THCa in to THC with direct exposure to heat or even lighting. While THC is accountable for the blissful “high” associated with marijuana intake, THCa performs certainly not produce psychoactive effects on its own. Instead, it supplies a special cannabinoid account along with prospective therapeutic buildings.

Looking Into the Potential Benefits

Research study in to the restorative results of THCa is actually still in its onset, yet preliminary studies as well as unscientific evidence recommend a number of potential perks:

- Anti-Inflammatory Properties: THCa has presented assurance as an anti-inflammatory representative, which might make it valuable for managing conditions including arthritis, inflamed digestive tract health condition, and autoimmune conditions. By minimizing irritation, THCa might help minimize discomfort as well as boost overall lifestyle for people.

- Neuroprotective Effects: Some investigation suggests that THCa might have neuroprotective properties, indicating it can assist guard nerve cells from damage or even weakening. This possible makes THCa flowers a subject of passion for nerve disorders like Alzheimer’s health condition, Parkinson’s disease, and neuropathic ache.

- Antiemetic and Appetite-Stimulating Effects: THCa has actually been reported to have antiemetic properties, indicating it might help reduce nausea as well as vomiting. Also, like THC, THCa might activate appetite, making it potentially helpful for individuals experiencing appetite loss as a result of health care procedures or conditions such as HIV/AIDS or cancer.

- Antioxidant Activity: THCa exhibits antioxidant properties, which can easily aid defend tissues from oxidative stress and anxiety as well as damages brought on by cost-free radicals. Through scavenging cost-free radicals, THCa might bring about overall health as well as health and lower the threat of severe ailments.

- Possible Cancer Benefits: While more study is needed to have, some research studies have advised that THCa might have anti-cancer properties. It is actually been actually disclosed to inhibit the spread of cancer tissues and also generate apoptosis (cell death) in certain kinds of cancer, although the mechanisms behind these impacts demand additional examination.

Conclusion

While THC remains the superstar of the cannabis planet, THCa flowers supply a powerful option for those looking for the prospective therapeutic perks of cannabis without the psychoactive effects. Coming from its own anti-inflammatory and neuroprotective properties to its own ability to minimize nausea and also induce appetite, THCa shows potential in numerous regions of wellness and health. As investigation in to cannabinoids continues to develop, THCa flowers may become an important enhancement to the therapeutic cannabis landscape, delivering people with new possibilities for enhancing their lifestyle. Whether taken in fresh, in removes, or evaporated, THCa flowers supply an one-of-a-kind way to discover the diverse possibility of the cannabis vegetation.

Should You Move 401k to Gold for a More Secure Retirement?

In the realm of retirement planning, individuals are constantly seeking ways to fortify their financial future. One increasingly popular strategy is contemplating whether to move 401k to gold, a decision that sparks considerable debate within the investment community. As economic uncertainties persist and the quest for financial security intensifies, exploring alternative investment avenues like precious metals has become a topic of interest for many. This article delves into the key considerations surrounding the move to allocate 401k funds to gold and evaluates whether it stands as a viable option for a more secure retirement.

Understanding the 401k Landscape:

To embark on the decision-making process, it’s crucial to grasp the fundamental nature of a 401k. These retirement accounts are traditionally invested in a mix of stocks, bonds, and mutual funds. The move to gold involves a shift from these conventional investments to a tangible and historically valuable asset.

Why Consider Gold?

Gold has long been regarded as a hedge against economic downturns and inflation. Its intrinsic value, rarity, and resistance to market fluctuations make it an attractive option for those seeking stability in their retirement portfolios. Moving 401k to gold is, in essence, a bet on the enduring value of this precious metal.

Market Volatility and Diversification:

One of the primary motivations behind moving 401k to gold is the desire to diversify one’s investment portfolio. Gold’s price movements often exhibit a low correlation with stocks and bonds, offering a potential safeguard against market volatility. Diversification, when done thoughtfully, can enhance the resilience of a retirement portfolio.

The Role of Gold in Risk Management:

Advocates for moving 401k to gold argue that the metal serves as a form of insurance against systemic risks and currency devaluation. The historical track record of gold, especially during times of economic crisis, has led many investors to view it as a reliable store of value.

Potential Downsides and Considerations:

Despite the allure of gold, it’s essential to acknowledge the potential downsides. Gold doesn’t generate income like stocks or bonds, and its value is largely dependent on market sentiment.

Regulatory and Tax Implications:

Before making any decisions, it’s crucial to understand the regulatory and tax implications of moving 401k to gold. There may be restrictions or penalties associated with such a transfer, and consulting with financial professionals is advisable to navigate potential pitfalls.

The Importance of Professional Guidance:

Deciding whether to move 401k to gold is a complex choice that warrants careful consideration. Seeking advice from financial planners, investment experts, and tax professionals can provide valuable insights tailored to individual circumstances.

Balancing Act:

Ultimately, the decision to move 401k to gold is a balancing act between risk and reward. In spite of the fact that gold could provide an additional layer of security, it is essential to find a balance that is in accordance with one’s long-term financial objectives and level of risk tolerance.

Examining Historical Performance:

Analyzing historical trends can, however, provide context for the potential role of gold in a diversified portfolio.

Global Economic Factors:

The decision to move 401k to gold should also take into account global economic factors. Gold prices can be influenced by geopolitical events, inflation rates, and the strength of major currencies.

Alternative Approaches to Gold Investment:

Moving 401k to gold doesn’t necessarily mean acquiring physical gold. There are alternative approaches, such as investing in gold exchange-traded funds (ETFs) or gold mining stocks. These options provide exposure to the potential benefits of gold without the challenges of storing and securing physical assets.

Monitoring Economic Trends:

Economic landscapes evolve, and so should retirement strategies. Regularly monitoring economic trends and reassessing the decision to allocate 401k funds to gold is essential. Flexibility and adaptability in investment decisions contribute to the agility needed to navigate changing financial climates.

Risk Mitigation and Financial Goals:

Before moving 401k to gold, investors should assess their risk tolerance and align it with their broader financial goals. A well-diversified portfolio considers individual circumstances, time horizon, and the level of comfort with market fluctuations.

Long-Term Outlook and Patience:

Retirement planning is inherently a long-term endeavor. Whether opting to move 401k to gold or pursue more traditional investment avenues, maintaining a long-term outlook is crucial. Patience in allowing investments to grow and weather short-term fluctuations contributes to the overall success of a retirement strategy.

Rebalancing and Reviewing Portfolios:

Regularly rebalancing investment portfolios is a prudent practice. Periodic reviews ensure that the asset allocation aligns with changing market conditions and individual financial objectives.

Consulting Financial Professionals:

Given the complexity of retirement planning and investment decisions, consulting with financial professionals remains paramount.

Monitoring Legislative Changes:

Legislative changes can impact retirement accounts and investment strategies. Keeping abreast of such changes allows investors to adapt their strategies accordingly.

Educating Yourself on Gold Markets:

Successful investing requires a degree of financial literacy. Before deciding to move 401k to gold, take the time to educate yourself on the dynamics of the gold market. Understand how factors like supply and demand, geopolitical events, and macroeconomic trends can influence gold prices.

Assessing Liquidity Needs:

The move to gold involves a shift from relatively liquid assets to a less liquid form. Consideration should be given to potential liquidity needs, such as medical expenses or unexpected financial obligations. Maintaining a balance between stability and access to funds is key in crafting a resilient retirement plan.

Psychological Aspects of Gold Ownership:

Gold ownership has psychological dimensions. Some investors find comfort in holding a tangible asset with intrinsic value, while others may feel more secure with the familiarity of traditional investments. Understanding one’s psychological approach to investing can influence the decision-making process.

Potential Alternatives to Gold:

Despite the fact that gold is often seen as a safe-haven asset, there are other investing opportunities that should be investigated. Real estate, dividend-paying equities, and other assets that are in line with an individual’s financial objectives and level of comfort with risk might be included in the definition of diversification. Diversification can also include precious metals.

Regular Portfolio Reassessment:

Economic conditions, personal circumstances, and investment goals can evolve over time. Regularly reassessing the portfolio, even if a decision to move 401k to gold has been made, ensures that the investment strategy remains in harmony with changing dynamics and long-term objectives.

Educating Family Members:

Therefore, it is of the utmost importance to educate family members on the reasoning behind this choice, particularly if the decision to convert 401(k) funds into gold is part of an entire estate planning strategy. Open communication can help ensure that heirs are aware of the investment strategy and can make informed decisions in the future.

Safeguarding Against Fraud:

With the rise of interest in gold investments, there’s a potential for scams and fraudulent schemes. Investors should exercise caution, conduct due diligence on any investment opportunities, and verify the legitimacy of entities offering gold-related products or services.

Utilizing Professional Advisory Services:

Professionals can tailor advice to individual circumstances, helping investors make sound decisions aligned with their unique financial goals.

Staying Informed on Economic Indicators:

When it comes to making educated judgments about the distribution of retirement money, having a comprehensive awareness of economic indicators has the potential to be of great assistance. These indicators include rates of inflation, interest, and unemployment. These indicators can impact the performance of both traditional and alternative investments.

Ongoing Market Research:

Markets are dynamic, and ongoing research is vital for successful investing. Stay informed about global economic trends, changes in monetary policy, and developments that may influence the performance of gold and other assets in the retirement portfolio.

Reviewing Insurance Coverage:

While gold is often considered a form of financial insurance, traditional insurance coverage for health, property, and other aspects of life should not be overlooked. A comprehensive approach to financial security includes a review of insurance policies to ensure adequate coverage.

Evaluating Impact on Overall Asset Allocation:

The decision to move 401k to gold should be viewed in the context of overall asset allocation. Consider how the inclusion of gold fits within the broader investment strategy, ensuring that the portfolio remains well-balanced and aligned with long-term financial objectives.

Conclusion:

In the pursuit of a secure retirement, the question of whether to move 401k to gold is a multifaceted one. It demands a thorough understanding of personal financial objectives, risk appetite, and the intricacies of the gold market. It is possible to make more educated choices about the distribution of retirement money if one has a comprehensive awareness of economic indicators, such as the rates of inflation and interest, as well as the numbers for unemployment.

Financial Security With Birch Gold Group And Precious Metals Ira Companies

Navigating Financial Security With Birch Gold Group: Exploring Rare-earth Elements Individual Retirement Account Providers

Birch Gold Group Precious Metals Ira Companies In the realm of economic security, diversification is essential. One such opportunity that has actually obtained traction and interest over the years is actually buying metals. With the myriad of companies assisting in these assets, Birch Gold Group attracts attention as a prominent gamer, especially in the domain of Precious Metals IRA.

Understanding Precious Metals Ira

Individual Retirement Accounts (IRAs) act as a vital element of lots of folks’s retirement plans, giving income tax perks for savings. Within the IRA garden, Precious Metals IRAs have actually gotten appeal as a means to expand profiles and also protect against market dryness.

A Precious Metals IRA allows people to purchase physical rare-earth elements like gold, silver, platinum eagle, and palladium, providing a substitute asset lesson past typical equities, connects, and also investment funds.

Birch Gold Group: An Overview

Birch Gold Group emerges as a noteworthy facility in the world of Precious Metals IRAs. Prominent for its proficiency and customer-centric method, Birch Gold Group helps people in diversifying their retirement profiles through combining physical precious metals.

The business’s dedication to openness and education and learning establishes it apart. Birch Gold Group prioritizes client education and learning, using resources as well as personalized guidance to aid individuals get through the ins and outs of gold and silvers expenditures, particularly within the IRA structure.

What Sets Birch Gold Group Apart?

Educational Resources: Birch Gold Group prioritizes customer education and learning, supplying detailed sources to make sure entrepreneurs are educated just before making decisions.

Personalized Assistance: Understanding the nuances of metals assets may be daunting. Birch Gold Group uses individualized aid to help customers adapt their collections depending on to their economic targets and also run the risk of tolerance.

Openness: The business positions focus on transparency, guaranteeing clients have a clear understanding of expenses, methods, and the attributes of their investments.

Individual Retirement Account Expertise: Birch Gold Group focuses on Precious Metals IRAs, leveraging its know-how to guide clients with the details of establishing as well as managing these profiles.

Actions To Invest With Birch Gold Group

Consultation: The adventure normally starts along with an assessment where Birch Gold Group’s experts evaluate a person’s economic condition as well as retired life targets.

Education and learning: Through academic products as well as customized assistance, clients gain a much deeper understanding of the precious metals market and also how it aligns with their investment purposes.

Account Setup: Birch Gold Group helps in putting together a Precious Metals IRA, helping with the acquisition and also storage of the decided on metallics within the IRS-approved managers.

Recurring Support: Post-investment, the business continues to offer help, keeping an eye on market styles as well as offering direction on collection corrections if needed to have.

Birch Gold Group: Nurturing Financial Futures Through Precious Metals IRAs

In the pursuit of financial security, diversity frequently emerges as an essential technique. One of the myriad investment choices readily available, Precious Metals IRAs have obtained interest, delivering an unique pathway to fortify retired life portfolios. At the forefront of helping with these expenditures remains Birch Gold Group, a reputable entity specializing in Precious Metals IRAs

Demystifying Precious Metals IRAs.

Individual Retirement Accounts (IRAs) contribute in protecting a pleasant retirement life. Within this landscape, Precious Metals IRAs encourage capitalists to expand their portfolios beyond typical assets like shares and also connections. They permit the addition of substantial properties like gold, silver, platinum eagle, and palladium, recognized for their historical worth and possible to dodge versus financial unpredictabilities.

Birch Gold Group: A Beacon Of Expertise

Birch Gold Group has carved a niche market in the monetary planet through providing detailed solutions focused on Precious Metals IRAs. What collections Birch Gold Group apart is its own commitment to offering clients with certainly not merely expenditure options yet additionally education and learning and also guidance.

The Pillars Of Birch Gold Group’s Success

Educational Empowerment: Birch Gold Group believes in enabling clients with know-how. They supply a variety of sources, from write-ups and also guides to personalized assessments, making sure real estate investors make informed choices lined up with their financial desires.

Client-Centric Approach: The provider’s dedication to placing clients first shines by means of in its own personalized approach. Recognizing that each client’s targets and also risk endurance vary, Birch Gold Group customizes its own guidance as well as suggestions as needed.

Clarity and also Trust: Transparency creates the base of Birch Gold Group’s operations. Clients can anticipate quality pertaining to charges, processes, and the nature of their investments, fostering depend on as well as self-confidence in their collaboration.

Field Of Expertise in Precious Metals IRAs: With a pay attention to Precious Metals IRAs, Birch Gold Group brings specialized know-how to the table, directing customers by means of the complications of putting together and also taking care of these accounts.

Actions To Enter The Precious Metals Ira Arena With Birch Gold Group

Consultation and Assessment: Birch Gold Group starts through recognizing the individual’s economic circumstances and also retirement life targets.

Education and also Guidance: Armed with this relevant information, the business teaches clients concerning Precious Metals IRAs, discussing exactly how these resources match their investment technique.

Account Setup as well as Management: Birch Gold Group helps in setting up the Precious Metals IRA, promoting the investment and also secure storage space of the chosen metallics through professional managers.

Ongoing Support: Even after the expenditure is actually produced, Birch Gold Group continues to deliver on-going support, keeping an eye on market patterns as well as using assistance for prospective profile modifications.

Final Thought

In an ever-evolving economic yard, diversity remains essential for a secure individual retirement account. Metals IRAs offered through providers like Birch Gold Group present a powerful alternative for those finding to secure their collections against market variations.

However, it is actually important to conduct thorough investigation, consider the pros and cons, and speak with monetary advisors prior to making any type of assets decisions. Birch Gold Group’s commitment to learning, openness, and also personalized assistance roles it as a famous contender in the world of Precious Metals IRA providers, serving individuals seeking to strengthen their retired life profiles with tangible possessions like gold, silver, platinum eagle, as well as palladium.

Gold Investments With Company IRA Gold

Recently, gold has actually regained its luster as a safe-haven investment, particularly throughout times of economic unpredictability. While typical Individual Retirement Accounts (IRAs) supply the adaptability of buying stocks, bonds, as well as mutual funds, Company IRA Gold presents an appealing alternative for those seeking to expand their retired life profiles with the classic attraction of gold. In this write-up, we explore the idea of Company IRA Gold, its advantages, as well as just how it can reinforce your retirement nest egg with the luster of this rare-earth element.

Augusta Precious Metals

Augusta Precious Metals is among the very best gold IRA firms for its high quality service and customer fulfillment.

With a team of educated and also seasoned professionals, Augusta Precious Metals provides consumers with quality solution and also support when it involves gold IRA investments.

They use competitive rates, a broad selection of products, and a safe and secure as well as risk-free environment to keep your financial investments. Augusta Precious Metals is among the best gold IRA companies, offering customers with the most effective possible experience and worth.

American Hartford Gold

American Hartford Gold is a top-rated gold IRA firm. They supply a range of solutions, making them among the very best gold IRA companies in the industry. Their client service is exceptional, with experienced staff that are constantly offered to answer inquiries.

Furthermore, they have competitive prices and supply a protected system for gold investments. With American Hartford Gold, you can rely on that your gold IRA investments remain in excellent hands.

They have made their reputation as one of the very best gold IRA firms, as well as they make sure to offer you with a safe and also safe experience.

GoldCo

GoldCo is one of the most effective gold IRA business. The company is renowned for its knowledge in gold IRAs, offering customers the highest quality gold products and services.

GoldCo’s well-informed staff and also affordable prices make it one of the leading gold IRA business.

GoldCo’s client service is unmatched and they have a long background of providing outstanding service and high quality gold investments. GoldCo is the perfect choice for anybody looking for the most effective gold IRA companies.

Birch Gold

Birch Gold is just one of the very best gold IRA firms. This business sticks out for its commitment to providing quality gold IRA solutions and also its commitment to offering consumers with the best customer service.

Birch Gold has a group of knowledgeable experts that supply individualized support as well as guidance when it pertains to gold IRA investments. They are likewise known for their competitive prices, making them one of the most effective gold IRA companies readily available.

Moreover, Birch Gold is dedicated to supplying customers with the best quality gold IRA services and products, making them a reliable and also trustworthy option when it involves gold IRA financial investments.

What Is A Gold IRA?

A Gold IRA is a retirement account that permits capitalists to hold physical gold and other rare-earth elements as part of their retirement cost savings portfolio.

Gold IRA firms provide financiers the chance to diversify their retired life financial savings by buying a variety of gold and various other rare-earth elements.

Investing in gold via a Gold IRA can aid capitalists shield their retired life savings from market volatility, as well as supply a hedge versus inflation. With the help of gold IRA companies testimonials, investors can locate the best business to fulfill their retirement needs.

Understanding Company IRA Gold

A Company IRA Gold is a customized retirement account that enables people to purchase physical gold, gold-related possessions, and precious metals within a company-sponsored IRA. This choice is particularly attracting capitalists that identify the innate worth and also security of gold, which frequently functions as a bush against inflation as well as economic market volatility.

While traditional IRAs normally limit financial investment choices to supplies, bonds, and also mutual funds, Company IRA Gold prolongs the series of financial investment possibilities to consist of gold bars, coins, as well as other tangible possessions. This distinct function equips investors to diversify their portfolios and also possibly minimize threats during unclear financial environments.

The Benefits of Company IRA Gold

Hedging Against Economic Uncertainty

Gold has actually historically been a beneficial bush against financial slumps, geopolitical stress, and also rising cost of living. When typical financial investments may fail, gold typically radiates as a shop of value and a safe-haven possession, giving capitalists with a complacency during turbulent times.

Portfolio Diversification

Diversification is a vital method for lowering danger in any investment portfolio. Firm IRA Gold supplies a possibility to branch out retired life savings beyond typical stocks and also bonds, possibly increasing the resilience of the general profile.

Tax obligation Advantages

Like typical IRAs, Company IRA Gold can give substantial tax benefits. Depending upon the kind of IRA selected (Roth or Traditional), capitalists can benefit from tax-deferred growth or potentially tax-free withdrawals during retirement, subject to the IRS regulations.

Prospective for Long-Term Growth:

While gold is usually viewed as a steady possession, its value can additionally appreciate over the long-term. As demand for gold continues to increase globally, the potential for long-term growth makes Company IRA Gold an attractive choice for capitalists looking for to protect their financial future.

Control as well as Security:

By buying physical gold or gold-related possessions, financiers get a concrete feeling of control over their retired life financial investments. Unlike other forms of financial investments that exist only on paper or in electronic form, having physical gold supplies a degree of safety and security as well as satisfaction.

FeatureGold IRA Companies Reviews: Exploring the Best Options for Retirement Planning

In the realm of retirement organizing, the look for dependable and also protected assets choices has actually led numerous people to look into Gold IRA business. As the monetary landscape progresses and also traditional financial investment cars face uncertainties, clients are considerably looking to metals to protect their wide range. This write-up is going to look into the world of Gold IRA companies reviews to aid you create educated choices concerning your retired life funds.

Understanding the Significance of Gold in Retirement Planning:

Gold has actually long been respected as an outlet useful, a bush against inflation, and a substantial possession along with intrinsic really worth. As economic gardens change, the allure of gold in a retirement portfolio becomes obvious. Gold IRAs, or even Individual Retirement Accounts backed through bodily gold, present a convincing choice to conventional retirement life investments. These profiles deliver the potential for both funds gratitude and wide range conservation, creating them a desirable option for those looking for stability in their retirement life profiles.

Elements to Consider When Choosing Gold IRA Companies:

Browsing the garden of Gold IRA business requires careful point to consider of several variables to make certain the safety and growth of your retirement funds. Permit’s check out some crucial facets that should be evaluated when reviewing various possibilities.

Credibility as well as Reliability:

Prior to leaving your retirement financial savings to any type of Gold IRA provider, it is actually essential to examine its image and also dependability. Seek companies along with a proven performance history of delivering phenomenal solution and also clear deals. Reading client assessments and recommendations may deliver important insights right into the adventures of various other real estate investors.

Expenses and Costs:

Understand the expense framework of each Gold IRA company. While costs are actually an unavoidable part of dealing with precious metal IRAs, it is actually important to choose a business that offers reasonable rates without weakening on company premium. Surprise charges can erode your gains with time, so a clear understanding of expenses is actually necessary.

Storing Options:

The safe storage space of precious metals is actually an important point to consider. Professional Gold IRA companies give options for segregated as well as allocated storage. Segregated storage makes sure that your precious metals are actually maintained individually from others, while alloted storing means that specific bars or even pieces are actually given to your profile.

Educational Resources:

Buying Gold IRAs includes understanding the marketplace aspects and also the factors determining metal prices. The greatest Gold IRA firms deliver informative information as well as support to assist entrepreneurs create updated selections. Whether you’re a skilled entrepreneur or an amateur, access to extensive info is indispensable.

Customer care:

A reactive and also experienced customer service staff is critical when managing gold and silvers. Over time of market fluctuations or when you need to have aid with profile monitoring, having trusted client assistance can create a considerable variation in your total experience.

Gold IRA Companies Reviews– Exploring the Options:

Now that our experts have actually described the essential factors to take into consideration, permit’s look into a few of the top Gold IRA business without discussing details labels. These evaluations target to offer an overall review of what each business offers, permitting you to make a notified choice based on your specific necessities as well as inclinations.

Company A:

Along with a stellar online reputation in the sector, Company A has constantly illustrated reliability and clarity. They provide a range of storing choices, consisting of set apart as well as assigned storing, making sure the surveillance of your precious metals. Clients enjoy the company’s commitment to customer learning, giving useful information to improve their understanding of the metals market.

Company B:

Known for its affordable charge design, Company B stands out for offering affordable solutions without compromising on service premium. Their customer service crew is actually praised for its cooperation and experience. Additionally, the business provides an easy to use platform, making it simple for financiers to manage their Gold IRA accounts flawlessly.

Company C:

Financiers looking for a customized strategy may locate Company C desirable. This business gives tailored solutions to satisfy private retirement targets. With a pay attention to consumer complete satisfaction, Company C has gained an online reputation for going the extra mile to guarantee customers feel confident in their investment selections.

Variation and safeguarding versus market volatility are actually paramount in retirement preparation, as well as Gold IRAs give a substantial and also historically tested approach for accomplishing these purposes. The customer reviews delivered here work as a starting aspect, guiding you through the vital factors when picking a Gold IRA firm.

As you start this monetary experience, it’s crucial to remember that market conditions, economical variables, and personal situations can easily influence the performance of your Gold IRA. Frequently reviewing and also reassessing your financial investment tactic with help from monetary advisors is a prudent technique to ensure that your retirement portfolio continues to be lined up along with your targets.

It’s worth taking note that the companies stated in this post are actually illustratory instances and also perform certainly not represent specific referrals. Performing your as a result of persistance, featuring investigating and contrasting various Gold IRA firms, is critical to finding the best fit for your needs.

The mission for a secure and thriving retired life involves critical organizing and a commitment to conform to developing monetary gardens. Gold IRAs stand up as a dependable and time-tested possibility, delivering a concrete property that has in the past survived economical tornados. By carefully considering the variables summarized within this write-up, you can easily browse the landscape of Gold IRA business along with assurance, making certain that your retirement life portfolio is actually well-positioned for stability as well as development.

Like any type of financial investment, it is actually recommended to seek advice from monetary experts to modify your strategy to your particular circumstances. They may supply tailored assistance and also help you straighten your financial investment choices with your lasting economic targets. In the dynamic planet of retirement life preparing, remaining informed as well as practical is key to building and keeping wide range for a comfy as well as meeting retirement life.

Verdict:

In the pursuit of securing a dependable and also flourishing retirement life, Gold IRA business play an essential part. Through conducting comprehensive customer reviews and also taking into consideration elements including credibility, fees, storage options, instructional sources, as well as customer support, financiers can make knowledgeable decisions straightened along with their financial goals.

As you look into the assorted garden of Gold IRA firms, bear in mind that the choice inevitably relies on your distinct inclinations and targets. Whether you focus on low expenses, customized company, or educational resources, the right Gold IRA company for you is one that aligns along with your sight for a safe and also thriving retirement life. Make the effort to investigation and also examine each alternative, making sure that your chosen Gold IRA business aligns with your financial desires for the future.

The Smart Way to Invest in Precious Metals IRAs: Choosing an Approved Provider

Precious metals, such as gold, silver, platinum, and palladium, have long been seen as a safe haven asset and a hedge against inflation. This is because precious metals tend to hold their value over time, even during economic downturns.

In recent years, there has been a growing interest in investing in precious metals through individual retirement accounts (IRAs). This is because IRAs offer a number of advantages for precious metals investors, including tax benefits and the ability to hold physical gold and other precious metals in your account.

If you are considering investing in a precious metals IRA, it is important to choose an approved provider. An approved provider is a financial institution that is authorized to hold precious metals for retirement accounts.

How to choose an approved provider

There are a number of factors to consider when choosing an approved provider for your precious metals IRA:

- Reputation: Choose a provider with a good reputation and a track record of providing excellent customer service.

- Fees: Compare the fees charged by different providers. Some providers charge setup fees, annual maintenance fees, and transaction fees.

- Selection of precious metals: Make sure the provider offers a wide selection of precious metals to invest in.

- Storage options: The provider should offer secure storage options for your precious metals. You may want to store your metals at home or in a third-party storage facility.

Here are some tips for choosing the best precious metals IRA provider for you:

- Do your research. There are many different precious metals IRA providers to choose from, so it is important to do your research and compare different providers before making a decision.

- Read reviews. Read reviews of different providers to get a better idea of their reputation and customer service.

- Ask for referrals. Ask your friends, family, and financial advisor for referrals to precious metals IRA providers.

- Interview potential providers. Once you have narrowed down your choices, interview potential providers to learn more about their services and fees.

Once you have chosen an approved provider, you can open a precious metals IRA account and start investing in precious metals.

Here are some of the benefits of investing in a precious metals IRA:

- Tax benefits: Contributions to a precious metals IRA are tax-deductible, and withdrawals are tax-free in retirement.

- Diversity: Precious metals can help to diversify your retirement portfolio and reduce your overall risk.

- Protection from inflation: Precious metals are a good hedge against inflation, which can erode the value of your retirement savings over time.

- Safe haven asset: Precious metals are often seen as a safe haven asset, meaning that they tend to hold their value or even go up in value during times of economic uncertainty.

Investing in precious metals through an IRA can be a good way to protect your retirement savings and grow your wealth over time. However, it is important to understand the risks involved before investing in precious metals. Precious metals prices can fluctuate, and there is always the risk of loss.

Conclusion

Choosing an approved provider is the first step to investing in precious metals IRAs. By following the tips above, you can choose the best precious metals IRA provider for you and your financial goals.

The Advantages Of A Gold Ira Rollover – San Diego Magazine

A Comprehensive Guide to 401k to Gold Individual Retirement Account Rollovers

We will lead you with the procedure of a successful rollover as well as aid you make informed choices to secure your hard-earned retirement cash in our 401k to gold IRA rollover guide.

Gold IRA Rollover

For those wanting to safeguard their retired life assets, gold individual retirement account investments offer various benefits. Portfolio variety is one of the crucial benefits. San Diego Magazine gold IRA rollover

Diversification of a Profile

You can diversify your retired life cost savings far from paper assets as well as restrict your direct exposure to the threats related to typical investment choices by buying a gold IRA. This is specifically essential throughout financial recessions due to the fact that gold has historically held its worth also when other investments have collapsed.

Protect Yourself Versus Rising cost of living

One more big advantage of gold IRA investments is that they can be made use of as a hedge versus rising cost of living. With the continuous danger of rising cost of living deteriorating your retired life funds’ purchasing power, investing in a gold individual retirement account can assist protect your investment by keeping its worth in time.

Safety And Security Versus Market Volatility

Furthermore, real gold financial investments can work as a bush versus market volatility, providing security and satisfaction throughout tough financial times.

If you desire to surrender your 401k to a gold IRA, selecting a trustworthy gold individual retirement account firm is essential. This makes certain that your financial investments follow federal government regulations and are secured in the long run. A gold individual retirement account can be a fantastic addition to your retirement portfolio, providing safety as well as diversification to assist you achieve your monetary goals with the correct instructions and also support.

Download and install a cost-free gold IRA set from Augusta Rare-earth elements to uncover how to prevent frauds, recognize the risks related to gold financial investments, and also carry out a gold individual retirement account rollover without penalty, to name a few points.

Actions to an Effective 401k to Gold IRA Conversion

Adhere to these steps to properly roll over a 401( k) right into a gold IRA:

- Pick a trusted gold individual retirement account provider.

- Begin the 401k rollover procedure by opening a self-directed IRA account.

- Buy precious metals.

- Send them to a protected storage facility.

The areas that follow will certainly go through each of these procedures in detail, providing you with the understanding you need to make the change smoothly.

Selecting a Dependable Gold IRA Firm

Investigating as well as comparing different gold individual retirement account firms will help you discover a reputable and also reliable company that matches your needs and provides complete gold individual retirement account services. When picking a gold individual retirement account firm, experience, customer comments, and also prices are all crucial elements to think about.

Acquiring Rare-earth Elements

Once your gold IRA account has actually been established and also financed, you can start buying IRS-approved precious metals such as:

- Palladium, Platinum, as well as Gold

- Top-rated gold individual retirement account providers offer one of the most affordable pricing for silver and gold products as well as constantly guarantee that the precious metals you acquire are of the finest quality.

What exactly is a Gold IRA Rollover?

A gold IRA rollover is a technique that enables you to transfer assets from your regular individual retirement account, Roth IRA, 401( k), or any other pension to a self-directed IRA that holds physical gold and also other precious metals. This permits capitalists to diversify their retired life portfolios as well as protect their riches from market volatility.

How Can I Rollover My 401k to Gold?

Think about surrendering your 401k right into a gold IRA if you wish to diversify your possessions by investing in gold. To transform your 401k to gold, first open up an account with a gold individual retirement account service as well as execute a fund transfer.

Your funds will certainly be relocated to the gold individual retirement account after you have completed the required documentation for both your 401k administrator as well as the gold IRA provider, enabling you to acquire real gold and silver coins as well as bullion.

Factors to consider and also Implications for Taxation

Understanding the tax obligation ramifications and considerations when converting your 401k to a gold IRA is critical for a smooth change. The tax deferral until assets are taken in retirement is just one of the primary tax benefits of executing a 401k to gold IRA rollover. This uses for even more control over tax obligation repayments in addition to tax-free investment development.

Another aspect to consider is the potential fine for an indirect rollover. The funds will go through tax obligations and penalties if the transfer is not completed within 60 days. To prevent these fines, it is best to go with a direct rollover.

Ultimately, several gold financial investments, such as gold mining supplies as well as gold ETFs, are not qualified for tax breaks. Hence, when investing in a gold individual retirement account, it is critical to adhere to IRS policies and also standards to ensure conformity as well as maximise tax benefits.

Frequently Asked Questions About Gold Individual Retirement Account Rollovers

Exactly how can I move my 401( k) to a gold IRA?

To start the rollover treatment, get in touch with business that handles your 401( k) account as well as pick either a direct or indirect rollover. With a direct rollover, you must deal with your gold IRA supplier to complete a trustee-to-trustee transfer in accordance with internal revenue service guidelines.

You must withdraw monies from your present 401k and down payment them into your gold individual retirement account within 60 days (if you are above the age of 59 1/2). In many cases, an indirect rare-earth elements individual retirement account rollover is not recommended because it carries greater risk than a straight transfer.

Should I convert my 401k to a gold individual retirement account?

Relocating your 401k to gold is an intricate choice that can be influenced by a range of situations specific to your monetary circumstance. Moving your 401k to a gold individual retirement account, on the other hand, is an excellent technique to diversify your retired life portfolio and preserve your cash with a trusted asset.

What is the treatment for a gold individual retirement account rollover?

A gold IRA rollover entails shifting retired life savings from one account to another, either straight or indirectly. Depending on your preferences, the organization that holds your current pension can either transfer properties directly right into your brand-new gold IRA or you can take out and also transfer them yourself.

What are the main benefits of purchasing a gold individual retirement account?

A gold IRA is an exceptional lasting investment due to the fact that it offers portfolio diversity, market volatility protection, rising cost of living hedging, and wide range preservation during economic downturns.

Summary

Lastly, a 401k to gold individual retirement account rollover can offer numerous advantages, including profile diversity, market volatility defense, rising cost of living hedging, as well as possession conservation throughout financial declines.

You can effectively shift your retirement cost savings right into a gold IRA and secure your monetary future by following the actions laid out in this comprehensive guide, such as picking a credible gold IRA company, opening up a self-directed IRA account, starting the rollover process, and also purchasing precious metals.

Avoid regular rollover oversights including missing out on the 60-day restriction for indirect rollovers, buying in non-IRA-approved metals, as well as saving gold in your home. You might assure a seamless and penalty-free shift by adhering to internal revenue service demands as well as working with a knowledgeable gold individual retirement account carrier, securing your retirement funds and also increasing the potential benefits of a gold IRA.

Unveiling The Top Gold IRA Companies

Just how is your existing economic circumstance? If you resemble the majority of people, concerns are increasing. Rising cost of living continues to increase, together with financial problems. The stock exchange seems unpredictable most days, as well as individuals are stressed over their investments. If you were a conventional stock financier, what would certainly take place to your savings if every little thing came collapsing down?

Investment diversification is now more vital than ever. One of the easiest ways to diversify your financial investments is by investing in silver and gold. Gold IRA Companies, for instance, are coming to be preferred because they provide a bush versus rising cost of living that other financial investments can not.

To buy rare-earth elements intelligently, you will need to deal with the most effective gold IRA companies. It can take weeks or months to conduct the high-level study required for finding the appropriate firm.

Goldco

Goldco is first option for a couple of various factors. To start with, this company is unrivaled when it comes to customer support. As you begin investigating gold IRA companies, you will certainly find many do not deliver on customer service.

Goldco helps its customers every action of the way. They also function to enlighten people on investing in rare-earth elements. Goldco’s goal is not just to generate income off of a person however to help them succeed.

The company was founded in 2006 by Trevor Gerszt. Today, Goldco has a ranking of A+ on the Better Business Bureau and also a AAA rating on business Consumer Alliance.

Goldco’s head offices remain in Woodland Hills, California. At the time of this writing, Goldco has more than 1,000 5-star evaluations, showcasing how devoted they are to client satisfaction.

American Hartford Gold,

When you acquire precious metals from American Hartford Gold, they can deliver directly to your front door or to your depository of selection for a gold IRA. The firm is so sure of its treatments and devotion to customer complete satisfaction that they ensure them 100%.

American Hartford Gold has functioned considering that 2015, with Sanford Mann at the lead. Mann likewise works as the CEO and also has effectively thrust the business right into among the top places in the nation for wide range protection firms.

Whenever you decide to work with a precious metals dealer, you have to guarantee they have an excellent customer score. This implies carrying out some study. You can’t begin purchasing rare-earth elements without doing your research.

Augusta Precious Metals

Augusta Precious Metals was begun in 2012 by Isaac Nuriani. Headquartered in Casper, Wyoming, this firm supplies a client-focused strategy to gold IRA service. The business is family-owned and also treats its consumers like family members. They want you to be successful.

Currently, Augusta Precious Metals has an A+ score from the Better Business Bureau and an AAA ranking from Consumer Alliance. Augusta also has the top score at Trustlink.

If you check out reviews on Augusta Precious Metals, it is clear that they have set the bar high for other business. Augusta regularly gets 5-star scores from clients as well as has a 4.9 out of the 5-star average.

Birch Gold

If you desire assistance without stress, after that Birch Gold is right for you. The business has actually been around since 2003 and was begun by several of the top talents in the sector consisting of professionals from Citigroup and IBM.

Birch Gold is based in Burbank, California, and also maintains offices in Silicon Valley and San Francisco. Birch Gold has truly worked hard to establish itself as one of the most reputable gold companies in the country.

The Better Business Bureau has given Birch Gold an A+ rating, and the Business Consumer Alliance has given it a AAA rating. In fact, if you look them up on Trustlink, they get the highest rating of 5 stars.

Birch Gold Group shines when it involves new precious metals capitalists. They aid consumers roll over their retirement accounts to IRA as well as partner with leading vault names like Equity Trust and STRATA.

Why Should Anyone Invest In A Gold IRA?

Why should you purchase a gold IRA when there are so many other financial investing opportunities? We have all experienced the growing expense of living, particularly recently. Additionally, we have witnessed throughout history how stock market declines or even crashes can affect our financial situation.

Today, several financiers are worried about hedging their investments versus inflation. Precious metals are one of the best means to do simply that. Many individuals carefully chose to seek precious metals after the economic downturn that struck the United States back in 2007. Regrettably, we could be headed for an additional soon.

What creates economic downturns is that the dollar obtains overly filled with air as well as rapidly declines in worth. Decreases in dollar value are terrifying if you have investments that are tied to the stock market. The most crucial justification for investing in a gold IRA is to increase your investment portfolio and safeguard your financial future.

Why Do You Need To Invest In Gold Right Now?

Financiers can shield their investments with gold since it preserves its value also when the dollar value declines.

Gold remains to increase popular, making it a prominent choice for capitalists worldwide.

Gold limits the damages you will certainly experience when stock market problems arise.

Investing in gold permits financiers to remain in higher control of their monetary futures.

Types Of Gold IRA-What Are Your Options?

You have options if you’re thinking about getting a gold IRA. You must first educate yourself on what an IRA is and how it works. An individual retirement account, or IRA, is a type of retirement investing account that offers investors a number of tax advantages.

Self-directed IRAs are another name for gold IRAs. You can choose the possibilities for your investment with a self-directed IRA, including rare-earth elements.

Know the Gold Ira Companies Investing Guidelines Here

What to Consider Before Making a Gold Individual Retirement Account Financial Investment

Investing in Gold Ira Companies has benefits and downsides. It helps in portfolio diversity.

Most of retired life professionals advise that you invest 5% to 10% of your whole profile to rare-earth elements, although it could be difficult to make particular recommendations because investment choices are so personalized.

According to Ryan Sullivan, proprietor of the registered investment encouraging company Off the beaten track Financial and investment advisor, “precious metals can play a substantial function in a well-diversified profile.” “Historically, there hasn’t been a lot of a connection between the more comprehensive stock exchange and gold or various other rare-earth elements. Because of this, holding it is a sensible action if you wish to lower profile volatility.

It requires enhanced expenses.

Having a custodian store, guarantee, acquisition, ship, as well as move your personal belongings will certainly cost you a large penny. Furthermore, you’ll need to plan for yearly custodial costs, which are usually more expensive than normal IRA upkeep expenditures.

There is a fine for early withdrawal.

In a suitable world, you would certainly maintain gold in your IRA up until you retired, yet if you did, you ‘d have to pay a 10% very early withdrawal fine. At age 72, you should start taking obligatory circulations or you take the chance of paying extra in taxes.

Inquiries and also Responses pertaining to Gold IRAs

One of the most frequently asked questions regarding gold and precious metals IRAs are resolved listed below. Check them out to learn just how to open up an account to start accumulating assets for your retired life.

A gold IRA: What is it?

The assets maintained in a gold IRA are real gold bars, coins, or various other rare-earth element objects, instead of the typical individual retirement account’s (Individual Retirement Account) financial investments. A gold IRA is funded by gold, while a conventional IRA take care of paper properties.

What do companies offering gold IRAs do?

Self-directed IRAs are opened and taken care of by gold individual retirement account companies. You can transfer assets from basic Individual retirement accounts, 401( k) s, and certifying retirement fund accounts to a gold IRA account with the help of a professional gold individual retirement account supplier. They can additionally assist you buy, shop, and also market your gold financial investments. Although that these custodians are less usual, Orion Steel Exchange, Oxford Gold Team, Lear Resources, as well as Goldco are amongst the well-known gold individual retirement account firms.

Just how can I market my gold-backed individual retirement account?

After the account develops, you can take out the properties as well as demand that the steels be sent out straight to you to ensure that you can market or maintain them yourself. As a choice, you can make use of the firm’s buy-back program, give the custodian possession of the steels back, as well as use the cash however you such as. Some shareholders may make a decision to get a cash payout, acquire a brand-new asset, or move money to another account. The terms of the buy-back alternative vary amongst the majority of gold IRA suppliers. Prior to making an investment, make sure to validate your legal rights.

Just how protected are gold Individual retirement accounts?

Every investment includes some danger, and also gold IRAs are no exemption. You ought to meticulously take a look at the benefits and disadvantages of acquiring actual bullion. A gold IRA can supply a tax-efficient method to invest if you believe that gold is a worthy and also appropriate threat.

Are all the properties in gold IRAs gold?

As a result of the fact that they can additionally house investments in silver, platinum, or palladium, gold IRAs are occasionally referred to as “rare-earth element IRAs.” As long as the possessions fulfill the purity requirements as well as other restrictions developed by the IRS, these steels may be in bar or coin kind.

Can I surrender my gold IRA?

Yes, nevertheless not everybody receives rollovers, and there are various other restrictions. Inspect whether you can start a rollover by speaking to a gold representative. Several financiers make use of money from a 401( k) or typical individual retirement account to fund a gold individual retirement account. The same tax obligation regulations that relate to money rolled right into a regular or Roth IRA need to be adhered to for all gold individual retirement account rollovers. Some individuals decide to diversify their retired life funds by rolling over simply a portion of their individual retirement account or 401( k) to a gold individual retirement account.

Which is more suitable, gold coins or gold bars?

For your individual retirement account, you could make a decision to acquire bars and specific coins. Both are valued based upon the price of gold per ounce, although some individuals think coins are a much safer choice. Coins are less at risk to bogus, cost better prices, and are very easy to move or offer back. Coins that are among the most prominent consist of:

- – The gold American Eagle coin

- – The silver American Eagle coin

- – Platinum American Eagle coin

- – Palladium Maple Fallen leave coin

Whatever you choose to purchase, make sure you take care of a trustworthy gold individual retirement account company that offers a fair buy-back policy. Nonetheless, coin premiums are larger.

Optional Approaches of Gold Storage Space

Your bullion will certainly be accepted the steels of other capitalists as part of an assigned storage center. You might not get the specific same bullion you bought when you take out money; instead, you may obtain something comparable. A lot of people who don’t want exact private pieces of bullion can manage with this less costly technique of saving.

Your financial investments are kept apart from the properties held by various other investors in a different storage space box or safe with combined, or set apart, storage.

StoryComparing Top Gold IRA Custodians: Features, Fees, and Reputation

Identifying Gold IRA Custodians

Gold individual retirement account custodians are crucial in facilitating buying, saving areas, and the best circulation of gold within the pension. These gold ira custodian msn are usually financial institutions or specialized businesses licensed by the IRS to handle different buildings like rare-earth elements. When choosing a custodian, it’s necessary to think about elements such as reliability, experience, charges, and services supplied.

Checking Into Possible Custodians

Start your journey by performing a total study on prospective Gold IRA custodians. Search for a business with strong trustworthiness in the market and a document of top quality in customer care. Consider reviewing online examinations, inspecting scores from independent companies, and seeking recommendations from trusted monetary specialists.

Contrasting Costs and Expenses

Fees vary significantly among Gold individual retirement account custodians, influencing your overall financial investment returns. Some typical charges connected with Gold individual retirement account accounts include arrangement costs, yearly upkeep costs, storage area fees, and deal costs. Comparison cost frameworks throughout various custodians to ensure you acquire the best cash well-worth. Remember that the most inexpensive charges do not constantly correspond to the very best service, so evaluate the costs versus the high quality of services.

Evaluating Storage Space Options

Your gold holdings’ safety depends greatly on the storage space facilities used by your custodian. Countless Gold individual retirement account custodians supply various storage alternatives: set-apart storage, where your ownerships are held separately from others, and marked storage space, where specific bars or coins are marked to your account. Furthermore, consider variables such as insurance plan protection, accounting therapies, and the custodian’s record in securing clients’ properties.

Taking A Look At Customer Service and Support

A trustworthy Gold individual retirement account custodian must give exceptional client support to resolve your troubles and concerns quickly. Examine the responsiveness of feasible custodians by calling their customer assistance groups with issues regarding their solutions, account setup treatments, and economic investment options. Look for custodians who focus on openness and communication, which are crucial for a favorable, long-lasting partnership.

Identifying Financial Investment Options

Beyond physical gold, countless Gold IRA custodians provide a range of financial investment choices, including silver, platinum, and palladium, in addition to gold-backed ETFs and mining stocks. When examining these alternatives, consider your financial investment objectives, danger tolerance, and diversity strategy. A diversified profile can minimize risk and improve returns with time.

Analyzing Legal and Conformity Considerations

Guarantee that any Gold individual retirement account custodian you’re considering fully follows internal revenue service legislations controlling pension and alternate possessions. Look for custodians recognized by commendable companies such as the Bbb (BBB) and comply with market-perfect approaches. Stay clear of custodians with a history of governing offenses or authorized conflicts.

Making an Enlightened Choice

Outfitted with this substantial overview, you can confidently navigate the landscape of Gold individual retirement account custodians. Before selecting, research study, compare, and look at feasible custodians. Remember that the very best custodian can play a crucial role in helping you achieve your retirement objectives and shield your economic future with rare-earth elements.

Securing Your Retirement Investments

A Gold individual retirement account custodian’s key responsibility is to ensure conformity with IRS standards controlling self-directed pension plans. This consists of helping clients open and keep their Gold Individual retirement accounts, purchasing and keeping accredited precious metals, and maintaining precise documents for tax obligation coverage functions.

Among the critical methods Gold individual retirement account custodians secure your retired life investments is by supplying protected storage space solutions for physical rare-earth elements. Internal Revenue Service laws ask for the gold and other authorized steels held within a Gold individual retirement account to be saved in an authorized safe, generally a safe center run by a third-party custodian.

Expert Guidance and Aid

Past aiding acquisition and shopping rare-earth elements, Gold individual retirement account custodians supply experienced assistance and assistance to assist capitalists in making alert choices concerning their retired life profiles. This could include offering academic sources and market understandings to assist clients in comprehending the feasible advantages and dangers of buying gold and other rare-earth elements.

In Addition, Gold IRA custodians can assist customers browse the complex guidelines controling self-directed retirement accounts. This consists of ensuring conformity with internal revenue service needs for annual contributions, distributions, and coverage, as well as providing timely updates on any modifications or advancements that could influence their retirement planning methods.

Secret Needs for Analyzing Gold IRA Custodians

When assessing possible custodians for your Gold individual retirement account, several crucial standards should be thought of: